As we know, mapping out support and resistance levels on a

price chart is the most important core skill that any price action

trader will need to have, but really the ability to do so is the

foundation of any real trading strategy and without the ability to do

this in a professional, consistent manner can cause trading as a whole

to come crashing down on top of you very quickly. Traders tend to over

complicate support and resistance mapping and as a result they are left

with a very messy, confusing hard to read chart, sound familiar?

If an architect was to draw up plans for a building with scribbles & smudge marks all over the blue prints making it barely readable, then the builder is going to have a very difficult time using those plans to actually construct the building. The same analogy applies to your trading, if you are working with a chart overwhelmed with S/R lines, trend lines going in all directions and indicators loaded up to the wahzoo then you’re going to be extremely lost when it comes to making trading decisions.

Take a look at a chart I found below…

If an architect was to draw up plans for a building with scribbles & smudge marks all over the blue prints making it barely readable, then the builder is going to have a very difficult time using those plans to actually construct the building. The same analogy applies to your trading, if you are working with a chart overwhelmed with S/R lines, trend lines going in all directions and indicators loaded up to the wahzoo then you’re going to be extremely lost when it comes to making trading decisions.

Take a look at a chart I found below…

A quick search of the forums and it didn’t take me

long to find traders posting up charts littered with support and

resistance lines. Take a look at this chart I found above, instead of

keeping things straight forward and simple, this trader has gone

overboard and created an environment that is difficult to trade in,

there is absolutely no need for this and is simply extreme over kill.

So what I am essentially saying here is that you don’t need to crazy with marking out support and resistance levels, in fact you only need to mark out the significant levels that are surrounding the current price movements, in some cases we will only have 1 line marked on the chart and that’s all we will need at the time to analyse the chart, really anything over 3 lines marked on the chart would start to be considered too busy. By only marking out what is necessary you will keep your charts tidy, simple and easy to read and this makes price action movements much more obvious.

So what I am essentially saying here is that you don’t need to crazy with marking out support and resistance levels, in fact you only need to mark out the significant levels that are surrounding the current price movements, in some cases we will only have 1 line marked on the chart and that’s all we will need at the time to analyse the chart, really anything over 3 lines marked on the chart would start to be considered too busy. By only marking out what is necessary you will keep your charts tidy, simple and easy to read and this makes price action movements much more obvious.

So what is support & resistance?

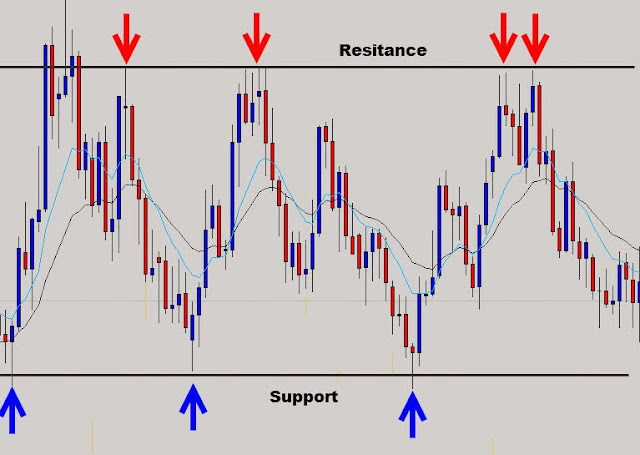

Support and Resistance are the key turning points

in the market, areas or specific price levels where price does the ‘stop

and reverse’ action, creating new swing lows or swing highs or

re-testing existing ones. The more often price does this stop and

reverse action at a specific level, the ‘stronger’ or more’ significant’

that particular S/R level becomes.

It’s also worth noting that S/R that are more obvious on the higher time frames are considered to be higher in value, the higher the timeframe you work with the more significant the S/R becomes.

When mapping out S/R lines we work on the daily time frame as a –minimum-, then using weekly and monthly charts to mark out or confirm the more significant or ‘major’ levels in play.

Intraday levels are generally not worth worrying about as price can cut through these like a hot knife through butter; this is one of the reasons intraday or ‘day trading’ is much more difficult and has a very low success rate.

So let’s get a little more specific

Support is an area on the chart where the market demonstrates strong buying action, easily identifiable by price ‘bottoming out’ caused by bearish price action movement being overrun by bullish pressure at a consistent point on the charts. Support is often referred to as the ‘floor’ that price bounces off or has trouble getting past.

It’s also worth noting that S/R that are more obvious on the higher time frames are considered to be higher in value, the higher the timeframe you work with the more significant the S/R becomes.

When mapping out S/R lines we work on the daily time frame as a –minimum-, then using weekly and monthly charts to mark out or confirm the more significant or ‘major’ levels in play.

Intraday levels are generally not worth worrying about as price can cut through these like a hot knife through butter; this is one of the reasons intraday or ‘day trading’ is much more difficult and has a very low success rate.

So let’s get a little more specific

Support is an area on the chart where the market demonstrates strong buying action, easily identifiable by price ‘bottoming out’ caused by bearish price action movement being overrun by bullish pressure at a consistent point on the charts. Support is often referred to as the ‘floor’ that price bounces off or has trouble getting past.

Resistance is the opposite of support where you see

price ‘topping out’ as bullish price action movement is met with

overwhelming bearish activity at consistent levels on the charts.

Resistance is known as the price ‘ceiling’ that the market falls off or

has difficulty pushing through.

Support and resistance make up the major boundaries

of ranging markets, when a market is range bound the only levels you

really need to have marked out is the upper resistance ceiling and the

lower support floor of the range. We recommend to only trade price

action signals from these 2 levels, short signals at range resistance

and long signals at the range support is what we look for in price

ranges.

Trending Markets

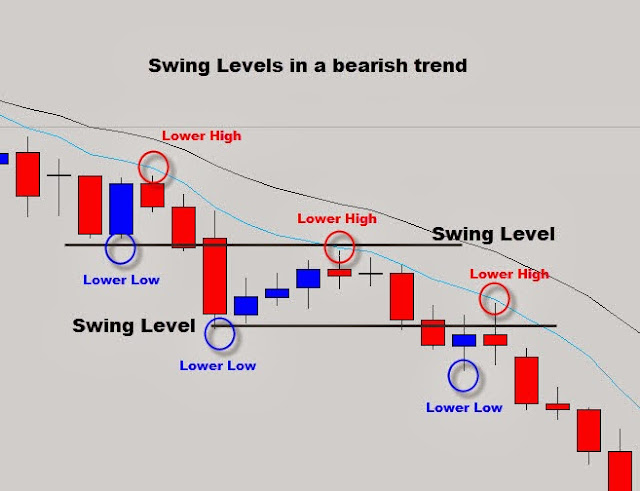

Trending markets are identified by using swing

points patterns, broken down into higher highs, higher lows, lower highs

and lower lows. These key points are called swing highs and swing lows

and the order they form in can help identify trends, especially in their

early stages.

During a bullish trend, price steps upward in a zig zag type pattern, gradually stepping its way higher forming a staircase look on the chart. Higher highs (or swing highs) in bullish trends is where the market finds resistance, then higher lows (or swing lows) is where the trend finds its footing back on support so trend momentum can kick back off and move into the next higher high. During a downward bearish trend, the opposite is true.

During a bullish trend, price steps upward in a zig zag type pattern, gradually stepping its way higher forming a staircase look on the chart. Higher highs (or swing highs) in bullish trends is where the market finds resistance, then higher lows (or swing lows) is where the trend finds its footing back on support so trend momentum can kick back off and move into the next higher high. During a downward bearish trend, the opposite is true.

Notice the staircase type zigzag upward motion –

price is finding support and resistance at the swing highs and swing

lows as it moves in a general upward direction.

In trending markets, the key levels that we recommend you have marked are the ‘Swing levels’, these are the areas of the chart where old resistance turns into new support or vice versa. Price Action signals that form off swing levels during trends have a highest success rate because firstly, there is already trend momentum backing the trade, and then second, a swing level that is a key turning point in the trend that adds to the chances that the trade will move in your favour.

Here is an example of a bearish trend and its related swing levels.

In trending markets, the key levels that we recommend you have marked are the ‘Swing levels’, these are the areas of the chart where old resistance turns into new support or vice versa. Price Action signals that form off swing levels during trends have a highest success rate because firstly, there is already trend momentum backing the trade, and then second, a swing level that is a key turning point in the trend that adds to the chances that the trade will move in your favour.

Here is an example of a bearish trend and its related swing levels.

In this downtrend we have marked out the swing levels (where old support levels have turned into new resistance).

To summarize; during trending markets it’s the swing levels that are most important to have mapped out on your chart because they are the key turning points in a trending environment. During range bound conditions it’s only vital to have the upper resistance and lower support marked out as these are the key areas of interest during ranges.

To summarize; during trending markets it’s the swing levels that are most important to have mapped out on your chart because they are the key turning points in a trending environment. During range bound conditions it’s only vital to have the upper resistance and lower support marked out as these are the key areas of interest during ranges.

The Weekly and Monthly Levels.

On a larger scale, strong weekly and monthly should

be marked on your chart when current price is the vicinity of them.

Support and resistance levels on this timescale are major turning points

in the market and want to be paid close attention to. Strong daily

price action signals that occur at significant weekly or monthly S/R can

be the catalyst for a strong move and a very profitable trade.

In the GBPUSD chart above, you can see how this

support level marked was acting as strong weekly support and had been a

key turning point in this market. Now price has broken through this

important level, the best course of action is to wait and see if the

market will now respect this old weekly support as new resistance. We

can confirm this if a bearish price action reversal signal forms when

price retests the old support.

As you can see in the examples given that we’ve

identified the key support and resistance levels in the market without

cluttering up the chart with mess. Like I said before you only need to

mark out the important levels that market is currently reacting with at

the present time.

No one cares about S/R 10 years ago, just concentrate what’s going on in the present markets because support and resistance levels do change over time, the market is not static, it’s dynamic so as it changes so do the support, resistance & swing level values. By marking only the levels the market is respecting at the present time will keep you in tune with market dynamics and have a much easier time making trading decisions.

Remember;

No one cares about S/R 10 years ago, just concentrate what’s going on in the present markets because support and resistance levels do change over time, the market is not static, it’s dynamic so as it changes so do the support, resistance & swing level values. By marking only the levels the market is respecting at the present time will keep you in tune with market dynamics and have a much easier time making trading decisions.

Remember;

-

Mark upper resistance and lower support in range bound markets, using Daily Time frame.

-

When price breaks a support or resistance level mark it on your chart and wait for a signal to confirm it as a swing level

-

During trending conditions mark higher highs and lower lows and wait

for them to be confirmed as a swing level with a price action signal or

price bounce.

-

Mark the support and resistance levels on your chart that are

prominent on the weekly and monthly chart, only around the area where

current price is located.

-

Remember the higher the timeframe you mark your levels from the

higher the significance which gives trades that form off the higher

significant levels a higher chance of success.

I hope this simple article has given you some insight on how to identify and plot out support and resistance levels on your chart. My Tips is marking support resistance level have to be from daily and see movement price on h4 time frame.